When Does Child Tax Credit Disappear?

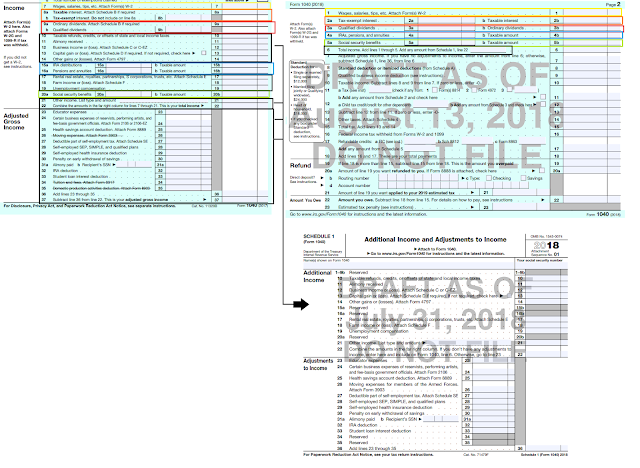

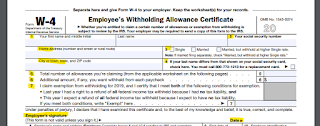

This is it. Only one more year until your dependent is 18 and can legally move out on their own. You've been counting down these moments since they turned 14 and started clearing out your fridge on a weekly basis. But just as any teenager does, they are going to hit you with one last gut punch before they ride off into their own lives. The Child Tax Credit (CTC) was formally introduced to the tax code in 1998. It has evolved into one of the most lucrative reasons to have a child this day and age (some might say the only reason). Starting in 2018 the CTC jumped up to $2,000 and is claimable to all parents, caregivers, and guardians as long as they are providing half the support and meet other tests to qualify. But while your child may forever be 8 years old in your eyes, the IRS sees them much differently. In the eyes of the IRS they reach adulthood at the age of 17 and the formally amazing tax return you used to have, just jumped off a ...

Comments

Post a Comment