Congratulations! You did it! You passed the interviews, you nailed the written personality tests and got the offer you wanted! The only thing stopping your road to success is a little paper work from HR.

It doesn't matter if you're working at a fast food restaurant, or if you're the CEO of a multinational corporation, you are about to receive payment for your services. Before the payment though, comes the paperwork. That first day you receive your paycheck will feel exhilarating. You'll pay some bills (probably), go out to eat, grab a drink, and finally put some gas in the car.

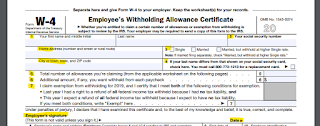

However, the amount of additional spending money you receive on that first paycheck is determined by your W-4. It's one of the papers that Karen, the head of HR, politely placed in your hiring packet and needs to have filled out and signed on her desk by morning.

You see, Karen of HR is in charge of processing your paycheck and submitting taxes to the federal government on your behalf. She's also in charge of submitting collected taxes to state or local organizations, unless you live in a state that has no income tax (looking at you, Wyoming). The amount withheld here determines whether or not you are getting a refund come tax time, or sending a money order to Uncle Sam.

You didn't go to law school. You barely passed Intro to Accounting. The W-4 itself looks incredibly intimidating. The font is size 4. There are three columns on two different pages. There are two worksheets that look the same at first glance but are completely different. There are tables, privacy notices, income amounts, employer instructions, maybe some passages from the Bible, who the hell knows at this point?

We get it, all you want to do is get paid and not have to worry about writing additional checks come April 15th to the Department of the Treasury.

Let's take this complicated form and explain it to someone who doesn't have a Master's Degree in Taxation.

The best way to think of allowances is to think of the opposite. The higher your allowances, the less they will withhold. The lower your allowances, the more they will withhold. It doesn't make sense, but this form was created by politicians.

This form can be condensed to some very basic and easy to answer questions. These are three things you should ask yourself before you start to read through any instructions:

- Am I currently married or will I be married by December 31st?

- If yes, does my spouse work?

- How many kids or dependents will I claim and what are their ages?

With these three questions answered, you are ready to roll. Remember, you only need to turn in Page 1 of this form. You can throw away pages 2-4 after you are finished filling it out.

Since you are only required to turn in Page 1, we will run through it line by line.

Box 1 - Your First Name, Middle Initial, Last Name: This must match your Social Security Card to prevent the employer from having any issues submitting your information.

Box 2 - Your Social Security Number: Again, this must match your current Social Security Card and is 9 digits long in the form ###-##-####.

Address Box: Make sure this is an address where you can receive mail as this is where pay stubs, year end W-2 forms, and any other additional information will be sent to.

Box 3 - Filing Status Single: If you are not legally married and plan on staying that way, check the Single Box. If you are married but the divorce will be final by December 31st, you are Single. If you are married but have maintained a separate residence and not lived with your spouse since June 30th, you are Single. If you are ridiculously paranoid about not having enough withheld and want to do everything you can in order to not pay the government come tax time, you are Single. If you are a single parent, check this box.

The Single status will withhold taxes at a higher amount than any other status. Again, you will have the most withheld out of your checks at the Single status.

Box 3 - Filing Status Married: If you are legally married, check this box. If you are engaged and will be married by December 31st, check this box. If you are going through a divorce that won't be finalized until after December 31st, check this box. If you are getting divorced and did not move out until after July 1st, and it will not be finalized until next year, check this box.

Box 3 - Married, but withhold at higher Single Rate: Check this box if you are filing a Married Filing Separate return. You may need to check this box if you have a working spouse to ensure that you are having enough withheld. If you aren't sure, look at your previous year income tax filing. If you aren't sure about this box, check with a local tax preparer.

Box 4 - Hopefully you don't have to check this box.

Box 5 - Allowances - Ballpark Method: If you have no desire to fill out a worksheet and you want to "ballpark it" on your allowances, add question 3 from your preparation questions to either 1 or 2 (1 if single, and 2 if married) and bada-bing-bada-boom, you're done.

Examples:

I am single and have no dependents. I checked the Single box and will put 1 in Box 5.

I am married, the only worker, and I have 2 kids. I checked the married box and will put 4 in Box 5.

I am single, claim one child on my taxes who lives with me, I checked the single box and put 2 in Box 5.

I am getting married in November, my spouse has 1 kid to claim this year but also makes a TON of money, I checked the Married but withhold at a higher single rate box and put 3 in Box 5.

The ballpark method will probably get you to a point where you aren't owing (or paying very little) taxes when you file a return. While it is not anywhere as precise as filling out the worksheets, it is a good starting point for those who do not want to go through the worksheets. Again, we don't promise that you will for sure have a refund if using this method, but it can still be used in simple tax situations.

For more complicated examples on allowances, or how to fill out the worksheet, see our other posts here.

Box 6 - Additional Amount: Feel like giving even more money to the government? Add any amount here that you want pulled from each check. The typical worker does not need to do anything with this box.

Box 7 - Exemption Verification: Feel like you aren't going to owe any taxes this year because your paycheck is so little? Want to roll the dice and hope you don't end up owing a crap ton of money to the IRS? Write "Exempt" on this line and your HR department will withhold NOTHING for your federal and state income tax. This is risky and isn't advised unless you've consulted with a professional tax preparer.

SIGN AND DATE

And you're done! Slap this baby on Karen's desk at 8:55 tomorrow morning! Again this method isn't for everyone and isn't as precise as filling out the worksheets but based on our experience, it will get you within a comfortable range of withholdings. If you want to know how to fill out the worksheets, check out our other posts here!

Great article about tax credit and child tax. I was looking for such amazing information. Can you please help me with ertc tax credit?

ReplyDelete